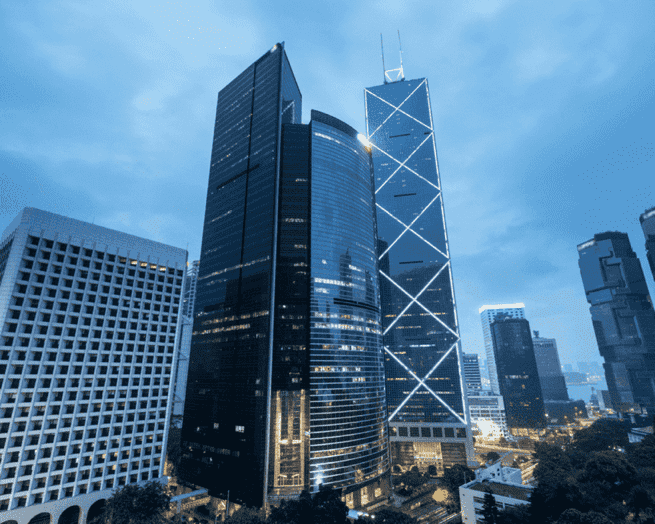

Projection: U.S. Commercial Lending to Decline by 38% in 2023

The Mortgage Bankers Association (MBA) predicts that total U.S. commercial and multifamily mortgage borrowing and lending will plummet by 38 percent this year, reaching a total of $504 billion.

The impact of these market conditions has been particularly evident in multifamily lending, which is a crucial component of the overall commercial lending sector. According to the MBA, multifamily lending, which is inclusive of the total figures, is expected to witness a steep decline to $299 billion in 2023. This drop represents a 38 percent decrease from the previous year's total of $480 billion. However, experts anticipate a rebound in borrowing and lending activities in 2024, with a projected total of $856 billion in commercial real estate lending, including $452 billion specifically in multifamily lending.

The key driver for this anticipated decline in U.S. commercial lending is the higher interest rates that borrowers are facing. As rates increase, businesses and individuals alike become more cautious about taking on debt, subsequently impacting the demand for commercial loans. Additionally, economic uncertainty further exacerbates the situation, as businesses tend to restrain investments and expansion plans until the economic climate stabilizes.

Despite these challenges, there is hope for the industry. Lenders and borrowers alike must adapt their strategies to meet the changing circumstances and seize the opportunities brought about by these shifting tides. Understanding market trends, improving loan products, and providing tailored lending solutions can help both lenders and borrowers navigate through this challenging period.

Projection: U.S. Commercial Lending to Decline by 38% in 2023

House Prices Fall in Switzerland: Key Insights Unveiled

Discover the shifting dynamics of Switzerland real estate market as apartment prices rise and single-family homes decline. Essential insights for buyers.

Discover the shifting dynamics of Switzerland real estate market as apartment prices rise and single-family homes decline. Essential insights for buyers.

Read moreCanada Real Estate: Positive Trends Amid Rate Changes

Discover how the recent interest rate cut impacts Canada real estate market, with a 9.1% rise in transactions in early 2024.

Discover how the recent interest rate cut impacts Canada real estate market, with a 9.1% rise in transactions in early 2024.

Read moreWhat are Top Real Estate Hotspots in Portugal for Foreign Buyer?

Discover why Lisbon, Porto, and Faro attract over 50% of non-resident loans in Portugal real estate market. Explore these thriving hotspots now!

Discover why Lisbon, Porto, and Faro attract over 50% of non-resident loans in Portugal real estate market. Explore these thriving hotspots now!

Read moreBrussels Real Estate Market Update: Prices Cool, Homes Still €100,000 Pricier

Discover how the Brussels real estate market is shifting, with a cooling trend in prices but homes still commanding high premiums.

Discover how the Brussels real estate market is shifting, with a cooling trend in prices but homes still commanding high premiums.

Read moreNew Zealand Real Estate Market Cools Further in June: A Comprehensive Analysis

Explore the latest trends as housing prices and sales decline across New Zealand. Get a comprehensive analysis of the cooling New Zealand real estate market.

Explore the latest trends as housing prices and sales decline across New Zealand. Get a comprehensive analysis of the cooling New Zealand real estate market.

Read moreLuxury Living: A New Investment Niche in UK Real Estate

Discover the resurgence of holiday let investments in the UK real estate market, presenting asset managers with lucrative opportunities in luxury living.

Discover the resurgence of holiday let investments in the UK real estate market, presenting asset managers with lucrative opportunities in luxury living.

Read moreInvestment Property with Pool in Portugal: 61% Higher Costs

Explore why investment property with pool in Portugal are 61% more expensive. Understand the market dynamics and benefits of pool ownership.

Explore why investment property with pool in Portugal are 61% more expensive. Understand the market dynamics and benefits of pool ownership.

Read moreWhy Foreign Investors Are Retreating from US Real Estate?

Explore the factors driving the decline in foreign investment in U.S. real estate and insights from experts on the shifting housing landscape.

Explore the factors driving the decline in foreign investment in U.S. real estate and insights from experts on the shifting housing landscape.

Read moreCyprus and Greece real estate market: Rental Yields Soar to New Heights

Explore the surge in rental yields in Cyprus and Greece, fueled by increasing overseas interest. Uncover the investment opportunities now!

Explore the surge in rental yields in Cyprus and Greece, fueled by increasing overseas interest. Uncover the investment opportunities now!

Read more