UK lender Abound secures £800m in financing round

UK-based credit technology firm Abound secures £800m in new financing round, including equity and debt financing from Citi and GSR Ventures.

Abound, a UK-based credit technology firm, has recently announced the successful completion of a new financing round, raising up to £800 million in a combination of equity and debt financing. This funding round includes an asset-backed debt financing arrangement from existing investor Citi, as well as a Series B equity component led by Silicon Valley-based GSR Ventures. This latest round of financing comes on the heels of a £500 million equity and debt raise secured by Abound last year.

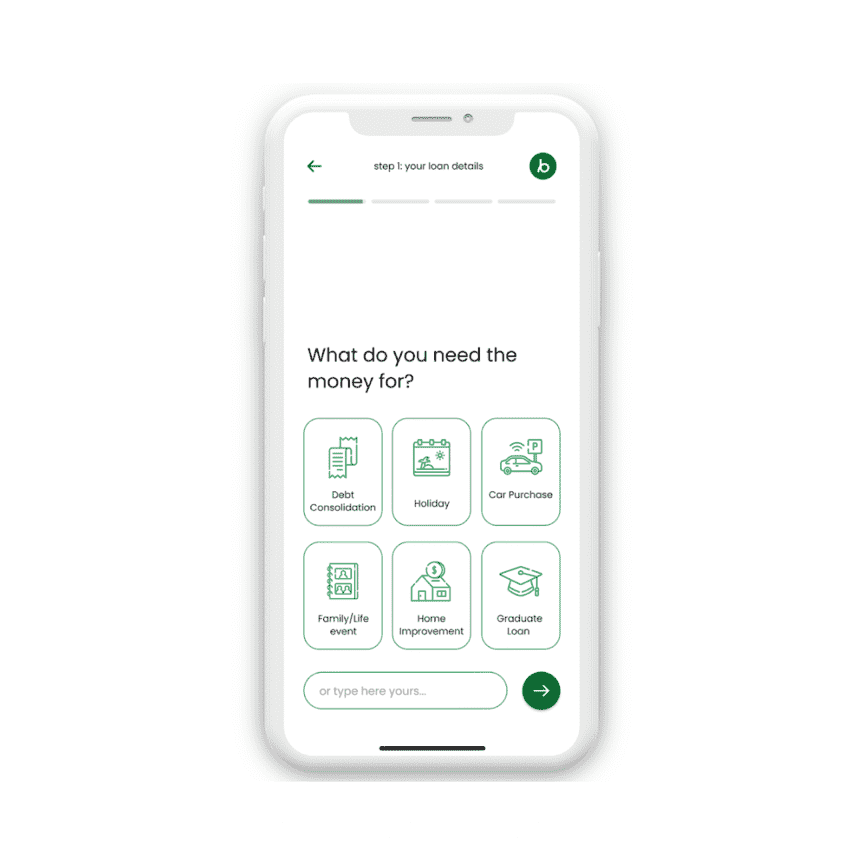

Founded in 2020 by Gerald Chappell and Dr. Michelle He, Abound prides itself on offering borrowers access to more affordable loans compared to traditional lenders. The company has already issued over £300 million in loans to date. With the new funding in place, Abound is looking to expand its presence in the UK market by venturing into prime lending. The company also aims to double its workforce from 65 to 130 employees this year.

One of the key areas where Abound plans to invest the new funds is in its proprietary AI-powered credit technology platform, Render. This platform leverages customers' open banking data to quickly assess their borrowing capacity. By using Render, Abound believes it can help enterprises make smarter credit risk decisions and extend their services to a wider range of customers, including those who may be considered "credit invisible."

Abound's latest financing round marks a significant milestone for the company as it looks to expand its reach in the UK market and enhance its technological capabilities. With a focus on providing more affordable loans and leveraging AI-powered solutions, Abound is poised for continued growth and success in the competitive credit technology sector.

UK lender Abound secures £800m in financing round

Permira Considers Sale of £1.5bn Stake in Evelyn Partners

Private equity firm Permira is exploring the sale of its £1.5bn majority stake in Evelyn Partners, signaling potential market shifts.

Private equity firm Permira is exploring the sale of its £1.5bn majority stake in Evelyn Partners, signaling potential market shifts.

Read moreTerraPay Transforms Cross-Border Payments with Mobile Wallets

Discover how TerraPay's new service connects 2.1B mobile wallets globally, revolutionizing cross-border payments for businesses and consumers.

Discover how TerraPay\'s new service connects 2.1B mobile wallets globally, revolutionizing cross-border payments for businesses and consumers.

Read moreMintos Expands in Europe with Launch in Portugal

Mintos officially launches in Portugal, marking a significant expansion in Europe and offering new investment opportunities for savvy investors.

Mintos officially launches in Portugal, marking a significant expansion in Europe and offering new investment opportunities for savvy investors.

Read moreTrever Raises €2.4M for Asset Management Platform, Eyes Expansion in Europe's Banking Sector

With a solid foothold in the DACH market, Trever secures funding to grow its client base among Europe's banking institutions.

With a solid foothold in the DACH market, Trever secures funding to grow its client base among Europe\'s banking institutions.

Read moreGrosvenor UK Invests in Europe’s Largest Proptech VC Noa

Discover how Grosvenor UK's investment in Noa is revolutionizing the built world industry, making it more digital, efficient, and accessible.

Discover how Grosvenor UK\'s investment in Noa is revolutionizing the built world industry, making it more digital, efficient, and accessible.

Read moreEPI Launches Wero: A Digital Wallet and Instant Payments Solution in Germany

Discover the latest innovation from The European Payments Initiative with the launch of Wero, a digital wallet and instant account-to-account payments solution in Germany.

Discover the latest innovation from The European Payments Initiative with the launch of Wero, a digital wallet and instant account-to-account payments solution in Germany.

Read moreGreek Neobank Snappi Granted Universal Banking License by ECB

Learn about how Snappi, a Greek neobank, secured a universal banking license from the ECB with the support of the Bank of Greece.

Learn about how Snappi, a Greek neobank, secured a universal banking license from the ECB with the support of the Bank of Greece.

Read moreTaxfix Expands to UK Market with TaxScouts Acquisition

German digital tax platform Taxfix partners with TaxScouts to streamline tax filing for UK users, making the process simpler and more empowering.

German digital tax platform Taxfix partners with TaxScouts to streamline tax filing for UK users, making the process simpler and more empowering.

Read moreCredAble Launches Revolving Short-Term Loans for MSMEs in FinTech Move

Discover how CredAble's new product addresses the $5.2 trillion financing gap for MSMEs, focusing on working capital shortages in India.

Discover how CredAble\'s new product addresses the $5.2 trillion financing gap for MSMEs, focusing on working capital shortages in India.

Read more