Topics: banking industry

Greek Neobank Snappi Granted Universal Banking License by ECB

Learn about how Snappi, a Greek neobank, secured a universal banking license from the ECB with the support of the Bank of Greece.

Learn about how Snappi, a Greek neobank, secured a universal banking license from the ECB with the support of the Bank of Greece.

Read moreING to Close Retail Banking in Luxembourg

ING announces closure of retail banking operations in Luxembourg, citing lack of sustainable growth in mass retail banking sector.

ING announces closure of retail banking operations in Luxembourg, citing lack of sustainable growth in mass retail banking sector.

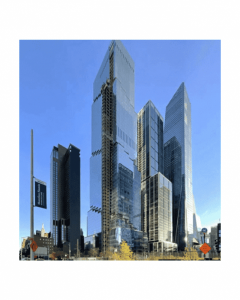

Read moreHSBC Unveils New U.S. Headquarters at The Spiral in Hudson Yards

Discover how HSBC's move to The Spiral in NYC's Hudson Yards showcases its commitment to innovation and reshaping the future of work.

Discover how HSBC\'s move to The Spiral in NYC\'s Hudson Yards showcases its commitment to innovation and reshaping the future of work.

Read moreDeutsche Bank Launches Discounted Mortgages for Climate-Friendly Homes

Learn how Deutsche Bank is leading the way in promoting sustainable housing in Germany with discounted mortgages for eco-friendly homes.

Learn how Deutsche Bank is leading the way in promoting sustainable housing in Germany with discounted mortgages for eco-friendly homes.

Read moreGB Bank Secures £85m Investment for Expansion Plans

Learn how GB Bank's recent £85m investment injection is accelerating their expansion plans in property project funding for SME developers and investors.

Learn how GB Bank\'s recent £85m investment injection is accelerating their expansion plans in property project funding for SME developers and investors.

Read moreStandard Chartered leads the way in offering locally domiciled funds to UAE retail clients

Find out how Standard Chartered is setting the standard by offering locally domiciled funds to retail clients in the UAE, in line with new SCA regulations.

Find out how Standard Chartered is setting the standard by offering locally domiciled funds to retail clients in the UAE, in line with new SCA regulations.

Read moreU.S. Banks Anticipate Tightening Credit Standards Despite Rising Loan Demand

A recent Federal Reserve survey shows U.S. banks preparing to maintain or tighten credit standards in response to falling interest rates and increased loan demand.

A recent Federal Reserve survey shows U.S. banks preparing to maintain or tighten credit standards in response to falling interest rates and increased loan demand.

Read moreWhat are Top Banking Trends 2024?

The banking industry is in a state of constant evolution, influenced by economic shifts, technological advancements, and geopolitical factors. As we enter 2024, it becomes crucial to recognize and comprehend the emerging banking trends that are poised to impact markets, businesses, and individuals.

The banking industry is in a state of constant evolution, influenced by economic shifts, technological advancements, and geopolitical factors. As we enter 2024, it becomes crucial to recognize and comprehend the emerging banking trends that are poised to impact markets, businesses, and individuals.

Read moreUnveiling the Secrets: How Troubled Swiss Banks Fought Back

The Swiss banking industry faced a challenging year in 2022 as the effects of the financial market fluctuations took their toll on the profits of local financial institutions.

The Swiss banking industry faced a challenging year in 2022 as the effects of the financial market fluctuations took their toll on the profits of local financial institutions.

Read moreThe Future of Credit Suisse and the Swiss Banking Industry: A Closer Look at UBS' Takeover

In a surprising turn of events, the renowned Credit Suisse brand is predicted to become extinct by 2026, as the Swiss banking industry faces a significant reduction in its workforce.

In a surprising turn of events, the renowned Credit Suisse brand is predicted to become extinct by 2026, as the Swiss banking industry faces a significant reduction in its workforce.

Read moreCanada: Laurentian Bank Reports $49.3M Q3 Profit, CIBC Bank Reports $1.43B Q3 Profit: The Analysis Revealed!

An In-depth Look into Canada Bank Updates: The Changing Landscape of Laurentian Bank and CIBC.

An In-depth Look into Canada Bank Updates: The Changing Landscape of Laurentian Bank and CIBC.

Read moreBreaking Barriers: Ireland's Minister and Banks Collaborate to Alleviate Homeowners' Interest-Rate Challenge!

In a proactive move to address the ongoing challenges faced by borrowers in the Republic of Ireland, Minister for Finance Michael McGrath recently engaged in a crucial meeting with representatives from the main retail banks, along with other industry stakeholders such as the Central Bank of Ireland.

In a proactive move to address the ongoing challenges faced by borrowers in the Republic of Ireland, Minister for Finance Michael McGrath recently engaged in a crucial meeting with representatives from the main retail banks, along with other industry stakeholders such as the Central Bank of Ireland.

Read moreUBS Sets Record in Banking Industry with $29 Billion Profit After Credit Suisse Takeover

UBS, the Swiss bank, has shattered banking industry records by reporting the largest quarterly profit ever achieved by a bank. The bank's remarkable success can be attributed to its takeover of Credit Suisse, which resulted in a staggering $29 billion profit.

UBS, the Swiss bank, has shattered banking industry records by reporting the largest quarterly profit ever achieved by a bank. The bank\'s remarkable success can be attributed to its takeover of Credit Suisse, which resulted in a staggering $29 billion profit.

Read moreBank of Japan Continues to Purchase Bonds at a Record High Rate

In recent years, the Bank of Japan (BoJ) has been bolstering its efforts to stabilize the economy by purchasing government bonds (JGBs) at an unprecedented pace.

In recent years, the Bank of Japan (BoJ) has been bolstering its efforts to stabilize the economy by purchasing government bonds (JGBs) at an unprecedented pace.

Read moreBank of Ireland Boosts Savings & Deposit Rates in Response to Customer Demands

Bank of Ireland, one of Ireland's leading financial institutions, is set to increase its savings and deposit rates, offering new and existing customers enhanced returns on their investments. This move comes as a response to the recent criticism faced by Irish banks for not passing on the benefits of higher interest rates to savers.

Bank of Ireland, one of Ireland\'s leading financial institutions, is set to increase its savings and deposit rates, offering new and existing customers enhanced returns on their investments. This move comes as a response to the recent criticism faced by Irish banks for not passing on the benefits of higher interest rates to savers.

Read moreUS Bank Deposits Fall for the Second-Straight Week as Lending Activity Rebounds

In the week ended Aug. 16, the most recent data from the Federal Reserve revealed that bank deposits experienced a decline for the second consecutive week.

In the week ended Aug. 16, the most recent data from the Federal Reserve revealed that bank deposits experienced a decline for the second consecutive week.

Read more