Multifi Boosts Credit Limits to £250,000 for UK Businesses

Discover how Multifi's increased credit limits can help UK businesses manage cash flow and seize growth opportunities more effectively.

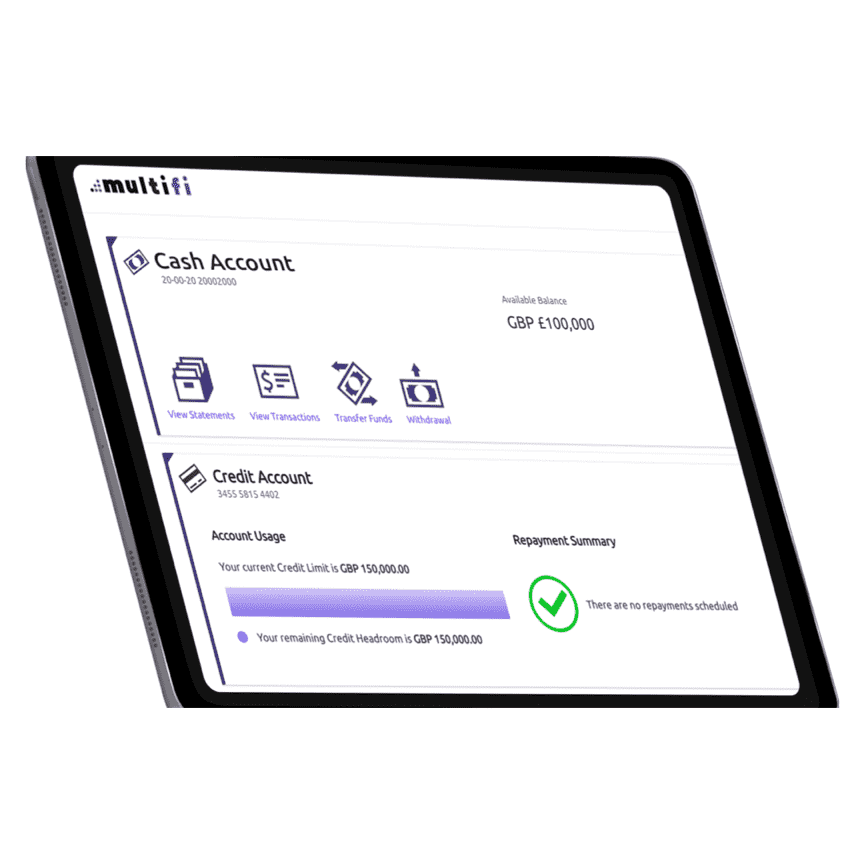

Multifi, a leading provider of innovative financial solutions for small and medium-sized enterprises (SMEs) in the UK, has recently announced an increase in credit limits from £200,000 to £250,000. This strategic move aims to provide UK businesses with greater financial flexibility to manage cash flow, seize growth opportunities, and navigate market dynamics more effectively in the post-pandemic economic environment.

As businesses strive to recover and adapt to the challenges brought about by the pandemic, access to sufficient capital remains crucial for their success and sustainability. Multifi's decision to raise credit limits underscores its commitment to supporting the UK's entrepreneurial ecosystem by offering enhanced financial services through its platform.

The new credit limit of £250,000 comes with a range of benefits for businesses, including enhanced financial flexibility, empowering business growth, and improved cash flow management. With this increased limit, businesses can now handle day-to-day operations more smoothly, take on larger projects or seasonal fluctuations without liquidity stress, and plan and execute their financial strategies more effectively.

It is important to note that all other credit limit features remain unchanged: fees are fixed, repayment terms stand at 120 days, credit remains revolving, and no collateral or personal guarantees are required. This means that businesses can access the additional capital without any additional burdens or constraints.

Multifi's decision to increase credit limits to £250,000 is a positive step towards supporting UK businesses in their growth and sustainability efforts. By providing greater financial flexibility and empowering business growth, Multifi is helping SMEs navigate the challenges of the current economic landscape and seize opportunities for success.

Multifi Boosts Credit Limits to £250,000 for UK Businesses

Permira Considers Sale of £1.5bn Stake in Evelyn Partners

Private equity firm Permira is exploring the sale of its £1.5bn majority stake in Evelyn Partners, signaling potential market shifts.

Private equity firm Permira is exploring the sale of its £1.5bn majority stake in Evelyn Partners, signaling potential market shifts.

Read moreTerraPay Transforms Cross-Border Payments with Mobile Wallets

Discover how TerraPay's new service connects 2.1B mobile wallets globally, revolutionizing cross-border payments for businesses and consumers.

Discover how TerraPay\'s new service connects 2.1B mobile wallets globally, revolutionizing cross-border payments for businesses and consumers.

Read moreMintos Expands in Europe with Launch in Portugal

Mintos officially launches in Portugal, marking a significant expansion in Europe and offering new investment opportunities for savvy investors.

Mintos officially launches in Portugal, marking a significant expansion in Europe and offering new investment opportunities for savvy investors.

Read moreTrever Raises €2.4M for Asset Management Platform, Eyes Expansion in Europe's Banking Sector

With a solid foothold in the DACH market, Trever secures funding to grow its client base among Europe's banking institutions.

With a solid foothold in the DACH market, Trever secures funding to grow its client base among Europe\'s banking institutions.

Read moreGrosvenor UK Invests in Europe’s Largest Proptech VC Noa

Discover how Grosvenor UK's investment in Noa is revolutionizing the built world industry, making it more digital, efficient, and accessible.

Discover how Grosvenor UK\'s investment in Noa is revolutionizing the built world industry, making it more digital, efficient, and accessible.

Read moreEPI Launches Wero: A Digital Wallet and Instant Payments Solution in Germany

Discover the latest innovation from The European Payments Initiative with the launch of Wero, a digital wallet and instant account-to-account payments solution in Germany.

Discover the latest innovation from The European Payments Initiative with the launch of Wero, a digital wallet and instant account-to-account payments solution in Germany.

Read moreGreek Neobank Snappi Granted Universal Banking License by ECB

Learn about how Snappi, a Greek neobank, secured a universal banking license from the ECB with the support of the Bank of Greece.

Learn about how Snappi, a Greek neobank, secured a universal banking license from the ECB with the support of the Bank of Greece.

Read moreTaxfix Expands to UK Market with TaxScouts Acquisition

German digital tax platform Taxfix partners with TaxScouts to streamline tax filing for UK users, making the process simpler and more empowering.

German digital tax platform Taxfix partners with TaxScouts to streamline tax filing for UK users, making the process simpler and more empowering.

Read moreCredAble Launches Revolving Short-Term Loans for MSMEs in FinTech Move

Discover how CredAble's new product addresses the $5.2 trillion financing gap for MSMEs, focusing on working capital shortages in India.

Discover how CredAble\'s new product addresses the $5.2 trillion financing gap for MSMEs, focusing on working capital shortages in India.

Read more