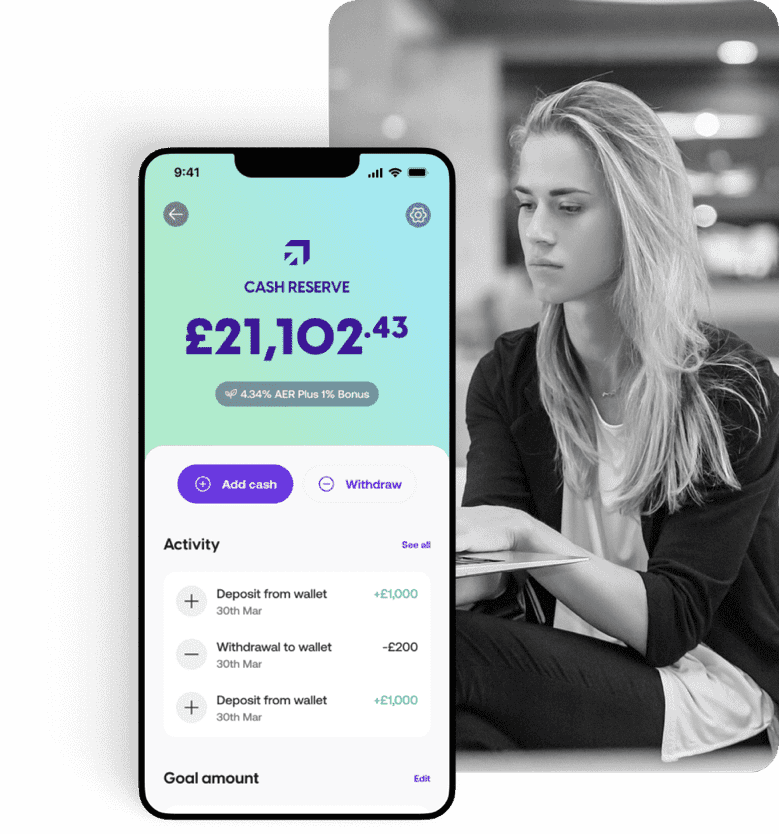

Sidekick Raises £8.5M for Wealth Management Platform

Sidekick secures £8.5M for its wealth management platform, fueling client expansion, product development, and licensing ambitions in Europe. Learn more about the investment and growth plans here.

Sidekick, a leading wealth management platform for investors, has successfully secured £4.5M in a Seed round and an additional £4M through a debt facility. The seed round was co-led by Pact VC and TheVentureCity, with support from MS&AD, Blackwood, and 1818, as well as previous investors Octopus Ventures, Seedcamp, and Semantic Ventures. The debt financing was provided by Columbia Lake Partners, known for backing successful companies like Mews, Factorial, Griffin, and Contentsquare.

Investors using Sidekick can borrow up to 40 percent of the value of their portfolio, subject to assessment, without the risk of a forced sale. This credit facility is backed by the investor's portfolio, allowing Sidekick to offer larger loan amounts, lower fees, and greater flexibility. The platform is designed to cater to investors looking for more long-term investment opportunities, rather than short-term gains through stock picking or robo-advisory services.

A recent report from the Resolution Foundation highlighted the growing wealth divide, with households in higher wealth deciles holding a larger portion of their assets in higher-returning investments. This disparity is attributed to varying liquidity needs, with lower-income households often holding more cash for unexpected expenses.

Sidekick's unique offering includes a Portfolio Line of Credit, a lombard lending product that helps investors stay invested over the long term while still having access to liquidity when needed. The company has obtained regulatory permissions from the FCA and launched its actively managed flagship equities product in January, setting itself apart as the only wealth management service in the UK to offer such a comprehensive solution.

Sidekick's innovative approach to wealth management provides investors with the tools and flexibility needed to grow their wealth over time, bridging the gap between traditional investment strategies and modern financial needs.

Sidekick Raises £8.5M for Wealth Management Platform

CredAble Launches Revolving Short-Term Loans for MSMEs in FinTech Move

Discover how CredAble's new product addresses the $5.2 trillion financing gap for MSMEs, focusing on working capital shortages in India.

Discover how CredAble\'s new product addresses the $5.2 trillion financing gap for MSMEs, focusing on working capital shortages in India.

Read moreCanada’s Haventree Bank Chooses Temenos for Lending and Banking Expansion

Haventree Bank, a Schedule 1 bank in Canada, partners with Temenos to enhance lending services and drive business growth through digital transformation.

Haventree Bank, a Schedule 1 bank in Canada, partners with Temenos to enhance lending services and drive business growth through digital transformation.

Read moreBank of America Partners with Simply Asset Finance to Provide £120 Million in Funding for UK Businesses

Bank of America's new partnership with Simply Asset Finance offers UK businesses access to £120 million in funding, solidifying their position in the UK Asset Finance market.

Bank of America\'s new partnership with Simply Asset Finance offers UK businesses access to £120 million in funding, solidifying their position in the UK Asset Finance market.

Read moreVipps MobilePay Enables Cross-Border Money Transfers in Nordic Region

Discover how Vipps MobilePay's 11.6 million users can now seamlessly transfer money between Norway, Denmark, and Finland with ease and convenience.

Discover how Vipps MobilePay\'s 11.6 million users can now seamlessly transfer money between Norway, Denmark, and Finland with ease and convenience.

Read moreGlobal Payments Acquires UK Payments Firm Takepayments

Global Payments makes strategic move with $250m acquisition of Takepayments, expanding its global reach in the payments industry.

Global Payments makes strategic move with $250m acquisition of Takepayments, expanding its global reach in the payments industry.

Read moreReal Estate FinTech Stake Secures $14m Investment for Saudi Expansion

Real Estate FinTech Stake secures a $14m investment to fuel its expansion into the lucrative Saudi real estate market. Stay updated on the latest developments in the FinTech industry.

Real Estate FinTech Stake secures a $14m investment to fuel its expansion into the lucrative Saudi real estate market. Stay updated on the latest developments in the FinTech industry.

Read morePrêts Secures €1m Funding to Make Sustainable Home Renovations Accessible

Learn how FinTech startup Prêts plans to use their recent investment to help more homeowners make energy-efficient home improvements.

Learn how FinTech startup Prêts plans to use their recent investment to help more homeowners make energy-efficient home improvements.

Read moreSteadily Partners with Tractic.io to Streamline Landlord Insurance for Real Estate Investors

Discover how Steadily and Tractic.io are revolutionizing landlord insurance for real estate investors, making the process seamless and efficient.

Discover how Steadily and Tractic.io are revolutionizing landlord insurance for real estate investors, making the process seamless and efficient.

Read moreBankTech Ventures’ Strategic Investments in Equabli, Filejet, and Monit

Discover how BankTech Ventures is revolutionizing community banking with investments in Equabli, Filejet, and Monit. Stay ahead of the curve.

Discover how BankTech Ventures is revolutionizing community banking with investments in Equabli, Filejet, and Monit. Stay ahead of the curve.

Read more