Small Business Banking Platform Relay Secures $32.2M in Series B Funding

Discover how Relay, the business banking platform providing cash flow clarity to small businesses, has successfully closed its $32.2 million Series B round.

Relay, the business banking platform dedicated to providing small businesses with clarity on their cash flow, has recently announced the successful completion of its $32.2 million Series B funding round. The round was led by Bain Capital Ventures, with participation from existing investors BTV, Garage, and Tapestry, as well as new investor Industry Ventures. This latest funding brings Relay's total funding to $51.6 million.

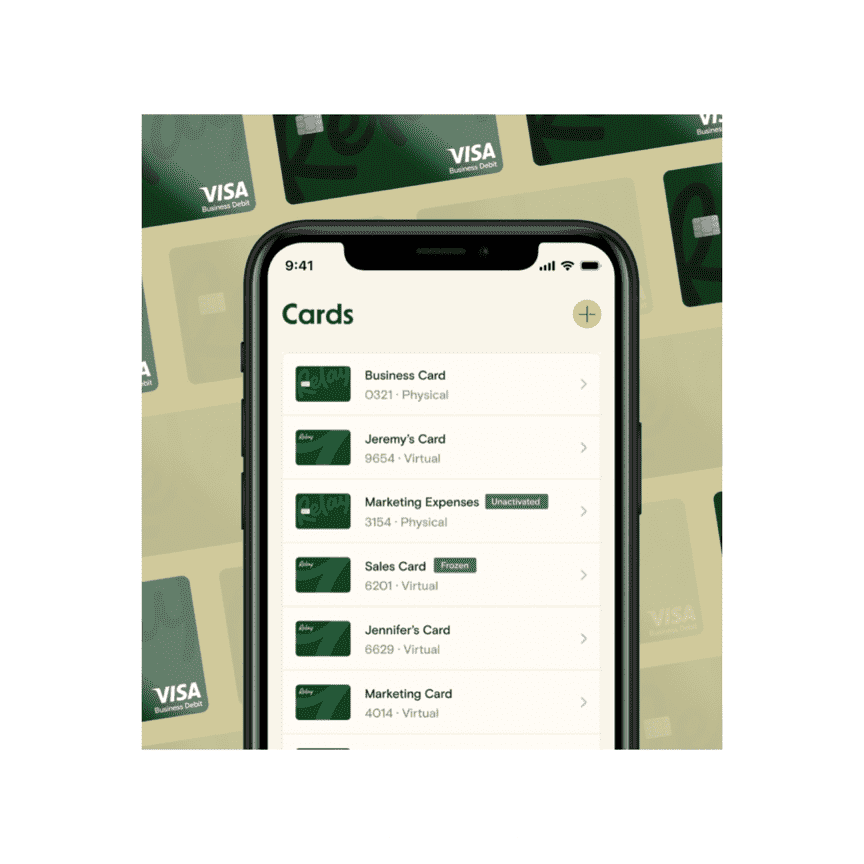

Relay's platform offers a comprehensive business banking solution tailored specifically for small and medium-sized businesses (SMBs). By focusing on tools that improve cash flow visibility and management, Relay aims to address the significant financial challenges faced by SMBs. The newly raised funds will be used to accelerate product development in key areas such as spend management, smart credit products, and the establishment of a financial API marketplace. These enhancements are designed to further Relay's mission of providing AI-powered predictive cash flow analytics to SMBs, enabling them to make better financial decisions and achieve greater stability.

The company has experienced impressive growth in recent years, with revenues tripling in 2022 and nearly sextupling in 2023. This growth underscores Relay's commitment to serving the small business market and helping SMBs overcome the common issue of cash flow management. In addition to its financial tools, Relay has partnered with the Profit First methodology, developed by entrepreneur Mike Michalowicz. This collaboration aims to assist SMBs in adopting better financial practices by utilizing a behavior-based cash management system.

Relay's latest funding round and strategic developments highlight the company's dedication to empowering small businesses with the tools and insights they need to thrive financially. With a focus on enhancing cash flow visibility and management, Relay is well-positioned to continue supporting SMBs in achieving financial success.

Small Business Banking Platform Relay Secures $32.2M in Series B Funding

Permira Considers Sale of £1.5bn Stake in Evelyn Partners

Private equity firm Permira is exploring the sale of its £1.5bn majority stake in Evelyn Partners, signaling potential market shifts.

Private equity firm Permira is exploring the sale of its £1.5bn majority stake in Evelyn Partners, signaling potential market shifts.

Read moreTerraPay Transforms Cross-Border Payments with Mobile Wallets

Discover how TerraPay's new service connects 2.1B mobile wallets globally, revolutionizing cross-border payments for businesses and consumers.

Discover how TerraPay\'s new service connects 2.1B mobile wallets globally, revolutionizing cross-border payments for businesses and consumers.

Read moreMintos Expands in Europe with Launch in Portugal

Mintos officially launches in Portugal, marking a significant expansion in Europe and offering new investment opportunities for savvy investors.

Mintos officially launches in Portugal, marking a significant expansion in Europe and offering new investment opportunities for savvy investors.

Read moreTrever Raises €2.4M for Asset Management Platform, Eyes Expansion in Europe's Banking Sector

With a solid foothold in the DACH market, Trever secures funding to grow its client base among Europe's banking institutions.

With a solid foothold in the DACH market, Trever secures funding to grow its client base among Europe\'s banking institutions.

Read moreGrosvenor UK Invests in Europe’s Largest Proptech VC Noa

Discover how Grosvenor UK's investment in Noa is revolutionizing the built world industry, making it more digital, efficient, and accessible.

Discover how Grosvenor UK\'s investment in Noa is revolutionizing the built world industry, making it more digital, efficient, and accessible.

Read moreEPI Launches Wero: A Digital Wallet and Instant Payments Solution in Germany

Discover the latest innovation from The European Payments Initiative with the launch of Wero, a digital wallet and instant account-to-account payments solution in Germany.

Discover the latest innovation from The European Payments Initiative with the launch of Wero, a digital wallet and instant account-to-account payments solution in Germany.

Read moreGreek Neobank Snappi Granted Universal Banking License by ECB

Learn about how Snappi, a Greek neobank, secured a universal banking license from the ECB with the support of the Bank of Greece.

Learn about how Snappi, a Greek neobank, secured a universal banking license from the ECB with the support of the Bank of Greece.

Read moreTaxfix Expands to UK Market with TaxScouts Acquisition

German digital tax platform Taxfix partners with TaxScouts to streamline tax filing for UK users, making the process simpler and more empowering.

German digital tax platform Taxfix partners with TaxScouts to streamline tax filing for UK users, making the process simpler and more empowering.

Read moreCredAble Launches Revolving Short-Term Loans for MSMEs in FinTech Move

Discover how CredAble's new product addresses the $5.2 trillion financing gap for MSMEs, focusing on working capital shortages in India.

Discover how CredAble\'s new product addresses the $5.2 trillion financing gap for MSMEs, focusing on working capital shortages in India.

Read more