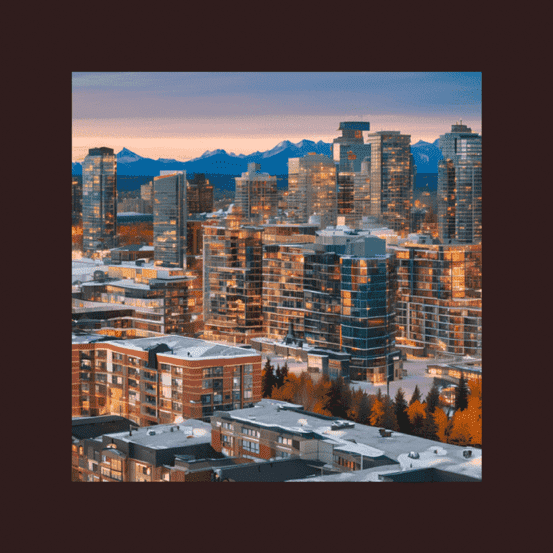

Unlocking the Potential of Commercial Real Estate Investing in Canada

Discover the benefits, property types, financing options, and market trends for commercial real estate investing in Canada. Make informed decisions with valuable insights.

Commercial real estate investing can be a lucrative venture, especially in a country like Canada with a stable economy and growing market. In this article, we will explore the ins and outs of commercial real estate investing in Canada, from the benefits and types of properties to consider, to financing options and market trends. Whether you are a seasoned investor or a beginner looking to diversify your portfolio, this guide will provide you with valuable insights to help you make informed decisions.

Understanding about to Commercial Real Estate Investing

Commercial real estate refers to properties that are used for business purposes, such as office buildings, retail spaces, industrial warehouses, and multifamily residential buildings. Investing in commercial real estate can offer several advantages over residential real estate, including higher rental income, longer lease terms, and potential for appreciation.

Benefits of Commercial Real Estate Investing in Canada

One of the main benefits of commercial real estate investing in Canada is the stable economy and strong market fundamentals. With a growing population and increasing demand for commercial spaces, investors can expect steady cash flow and long-term appreciation. Additionally, commercial properties often have higher rental yields compared to residential properties, providing investors with a reliable source of income.

Types of Commercial Real Estate In Canada

There are several types of commercial real estate properties to consider when investing in Canada, including office buildings, retail spaces, industrial properties, and multifamily residential buildings. Each type of property has its own unique characteristics and investment potential, so it is important to carefully evaluate your options before making a decision.

Factors to Consider Before Investing

Before diving into commercial real estate investing, it is essential to consider several factors, such as location, market trends, property condition, and potential for growth. Conducting thorough due diligence and working with experienced professionals, such as real estate agents and financial advisors, can help you make informed decisions and mitigate risks.

Financing Options for Commercial Real Estate Investments

Financing a commercial real estate investment can be challenging, as lenders typically require larger down payments and stricter lending criteria compared to residential properties. However, there are several financing options available, such as traditional bank loans, commercial mortgages, and private equity partnerships, that can help you secure funding for your investment.

Steps to Start Investing in Commercial Real Estate

To start investing in commercial real estate in Canada, you need to follow a series of steps, including setting investment goals, conducting market research, identifying potential properties, negotiating deals, and managing your investment portfolio. By following a systematic approach and seeking guidance from industry experts, you can increase your chances of success in the commercial real estate market.

Risks Associated with Commercial Real Estate Investing

Like any investment, commercial real estate comes with its own set of risks, such as market fluctuations, tenant turnover, property maintenance costs, and regulatory changes. It is important to be aware of these risks and develop strategies to mitigate them, such as diversifying your portfolio, maintaining a cash reserve, and staying informed about market trends.

Tips for Successful Commercial Real Estate Investing

To succeed in commercial real estate investing in Canada, it is essential to follow some key tips, such as conducting thorough due diligence, building a strong network of professionals, staying updated on market trends, and being patient and disciplined in your investment decisions. By following these tips and learning from experienced investors, you can maximize your returns and minimize risks.

Case Studies of Successful Commercial Real Estate Investments

To illustrate the potential of commercial real estate investing in Canada, we will explore some case studies of successful investments, highlighting the strategies and factors that contributed to their success. By studying these real-life examples, you can gain valuable insights and inspiration for your own investment journey.

Market Trends in Commercial Real Estate in Canada

The commercial real estate market in Canada is constantly evolving, with changing trends and dynamics that can impact investment opportunities. By staying informed about market trends, such as supply and demand dynamics, rental rates, and economic indicators, you can make informed decisions and capitalize on emerging opportunities.

Tax Implications of Commercial Real Estate Investing

Investing in commercial real estate can have significant tax implications, including property taxes, capital gains taxes, and depreciation deductions. It is important to understand the tax laws and regulations governing commercial real estate investments in Canada, and work with tax professionals to optimize your tax strategy and maximize your returns.

Exit Strategies for Commercial Real Estate Investments

Having a clear exit strategy is essential when investing in commercial real estate, as it allows you to plan for potential scenarios and maximize your returns. Common exit strategies include selling the property, refinancing the mortgage, or converting the property to a different use. By developing a solid exit strategy, you can ensure a smooth transition and achieve your investment goals.

Regulations and Laws Governing Commercial Real Estate Investing in Canada

Commercial real estate investing in Canada is subject to various regulations and laws, such as zoning regulations, building codes, and landlord-tenant laws. It is important to be aware of these regulations and comply with them to avoid legal issues and financial penalties. Working with legal professionals and industry experts can help you navigate the complex legal landscape and protect your investments.

Resources for Further Information

For more information on commercial real estate investing in Canada, you can explore resources such as industry publications, real estate websites, investment forums, and professional associations. By staying informed and networking with industry professionals, you can expand your knowledge and make informed decisions about your investments.

Commercial real estate investing in Canada offers a wealth of opportunities for investors looking to diversify their portfolios and generate passive income. By understanding the benefits, risks, and strategies involved in commercial real estate investing, you can make informed decisions and maximize your returns. Whether you are a seasoned investor or a beginner, the key to success lies in thorough research, careful planning, and continuous learning.

FAQs

1. What are the advantages of commercial real estate investing in Canada?

2. How can I finance a commercial real estate investment in Canada?

3. What are the key factors to consider before investing in commercial real estate?

4. What are the common risks associated with commercial real estate investing?

5. How can I stay informed about market trends and regulations in commercial real estate investing in Canada?

Unlocking the Potential of Commercial Real Estate Investing in Canada

Exploring Commercial Real Estate Investing in Canada: Benefits, Risks, and Steps

Discover the opportunities and challenges of commercial real estate investing in Canada. Learn how to diversify your portfolio and generate passive income in a stable economy.

Discover the opportunities and challenges of commercial real estate investing in Canada. Learn how to diversify your portfolio and generate passive income in a stable economy.

Read moreWhat is The Impact of Seasonality on Real Estate Investing?

Discover how timing your real estate purchase right in relation to the seasons can lead to significant savings for both buyers and sellers.

Discover how timing your real estate purchase right in relation to the seasons can lead to significant savings for both buyers and sellers.

Read moreAre Granny Flats a Smart Investment? Real Estate Investors Analyze the Numbers

Discover if granny flats are a profitable investment as real estate investors calculate potential rental income and construction costs in New Zealand.

Discover if granny flats are a profitable investment as real estate investors calculate potential rental income and construction costs in New Zealand.

Read moreUltimate Guide: How to Invest in Real Estate Investment Trust (REITs)

Learn the benefits, types, factors, risks, and tips for success in investing in real estate investment trusts (REITs). Compare with other investments and explore successful case studies.

Learn the benefits, types, factors, risks, and tips for success in investing in real estate investment trusts (REITs). Compare with other investments and explore successful case studies.

Read moreInvesting in Rural Real Estate in Portugal: A Comprehensive Guide

Discover the benefits, factors to consider, popular regions, property types, legal considerations, financing options, risks, and tips for successful investing in rural real estate in Portugal.

Discover the benefits, factors to consider, popular regions, property types, legal considerations, financing options, risks, and tips for successful investing in rural real estate in Portugal.

Read moreThe Ultimate Guide to Buying Foreclosed Homes and Flipping Them

Discover the benefits, risks, steps, financing options, renovation tips, marketing strategies, legal considerations, and tips for success in buying foreclosed homes and flipping them.

Discover the benefits, risks, steps, financing options, renovation tips, marketing strategies, legal considerations, and tips for success in buying foreclosed homes and flipping them.

Read moreHow to Use Debt to Build Wealth in Real Estate: A Strategic Guide

Discover the power of leveraging debt to maximize your real estate investments and build long-term wealth. Learn how to use debt to build wealth in real estate strategically.

Discover the power of leveraging debt to maximize your real estate investments and build long-term wealth. Learn how to use debt to build wealth in real estate strategically.

Read moreUnlocking Success: How to Get Investors for Property Development

Discover the essential steps on how to get investors for property development projects and secure the funding needed for success. Start your journey to financial growth today.

Discover the essential steps on how to get investors for property development projects and secure the funding needed for success. Start your journey to financial growth today.

Read moreHow to Invest in Real Estate Stocks: A Comprehensive Guide

Learn how to invest in real estate stocks to maximize your wealth. Discover effective strategies and tips in this informative article.

Learn how to invest in real estate stocks to maximize your wealth. Discover effective strategies and tips in this informative article.

Read more