Apartment Stocks Outperforming Other REITs Amid Tough Housing Market

Discover why stocks in companies that own apartment buildings are thriving in the current U.S. housing market, despite overall declines in the real estate sector.

Stocks in companies that own apartment buildings are proving to be more resilient than other real estate investment trusts in the current U.S. housing market. The FTSE NAREIT Equity REITs index, which includes various commercial property types, has seen a decline of 2.9% in the first five months of the year. However, the apartment segment of the index, consisting of 14 companies, has shown a total return of 5.2% during the same period.

AvalonBay Communities, one of the nation's largest apartment REITs, has seen a significant increase of about 22% since last October. With over 90,000 apartments under its management across the U.S., AvalonBay Communities ranks among the top performers in the industry, trailing only malls and health care property owners. Despite this positive performance, apartment REITs still lag behind the S&P 500’s total return of approximately 11.3% through May.

The housing market has been facing challenges due to a shortage of homes for sale and rising mortgage rates, leading to a decline in home sales. The median U.S. home sale price has surged by more than 40% since 2019, making it difficult for renters to save for down payments. Despite national rent declines over the past year, the resilience of apartment REITs stocks is evident. The median U.S. asking rent fell annually in April for the ninth consecutive month to $1,723, but remained only 1.9% below its 2022 peak.

The surge in new apartment construction has contributed to lower rents, but with many tenants unable to afford homeownership, demand for rental housing remains strong. A robust job market has also driven rents higher in several metro areas, particularly in the Midwest. Analysts at Raymond James & Associates recommend focusing on companies with properties in the West Coast and Midwest, as they are expected to be less impacted by the influx of new apartments compared to the Sunbelt region.

In their analysis of apartment REITs' first-quarter earnings reports, the analysts highlighted the steady demand and minimal pricing disruptions despite the supply wave. Occupancy levels have remained strong, and tenant turnover is at historically low levels, as move-outs to homeownership have significantly decreased. Essex Property Trust and Centerspace are among the analyst’s top picks, both receiving “Outperform” ratings.

The apartment segment of the real estate investment trust market has shown resilience in the face of challenges in the housing market. Despite rent declines and a surge in new construction, demand for rental housing remains healthy, driving the performance of apartment REITs stocks.

Apartment Stocks Outperforming Other REITs Amid Tough Housing Market

Emerging Market Equities Outperform US and Europe, Offering Highest Returns

Discover why investing in emerging market equities can yield higher returns than traditional markets like US and Europe. Stay ahead of the game.

Discover why investing in emerging market equities can yield higher returns than traditional markets like US and Europe. Stay ahead of the game.

Read moreUK Government Raises Investment Thresholds for High Net Worth Investors

Learn about the UK government's decision to reinstate private market investment thresholds, making it easier for high net worth individuals to invest.

Learn about the UK government\'s decision to reinstate private market investment thresholds, making it easier for high net worth individuals to invest.

Read moreInside Greece’s Last Golden Visa Program: What’s Changing

Explore Greece's golden visa program, one of Europe's last, and learn about upcoming changes to the controversial residency scheme.

Explore Greece\'s golden visa program, one of Europe\'s last, and learn about upcoming changes to the controversial residency scheme.

Read moreEurope’s Private Credit Funds Relying More on Banks for Funding

Discover the risks associated with European private credit funds turning to banks for funding, as research shows a record 80% utilizing 'subscription lines' in 2023.

Discover the risks associated with European private credit funds turning to banks for funding, as research shows a record 80% utilizing \'subscription lines\' in 2023.

Read moreNorthWall Capital Enhances Credit Business with Sentry Loan Portfolio Management

Learn how NorthWall Capital is optimizing its private debt portfolio with Broadridge's Sentry solution for efficient operations.

Learn how NorthWall Capital is optimizing its private debt portfolio with Broadridge\'s Sentry solution for efficient operations.

Read moreBNP Paribas and Citi Lead Strategic Investment in United Fintech Group Limited

BNP Paribas and Citi invest in United Fintech, signaling a shift towards collaborative fintech innovation. Join the transformative journey.

BNP Paribas and Citi invest in United Fintech, signaling a shift towards collaborative fintech innovation. Join the transformative journey.

Read moreSibstar Secures £125K Investment from Dragons’ Den to Enhance Financial Inclusion for Dementia Patients

Learn how Sibstar's innovative debit card and mobile app, backed by Sara Davies and Deborah Meaden, is revolutionizing everyday spending for individuals living with dementia.

Learn how Sibstar\'s innovative debit card and mobile app, backed by Sara Davies and Deborah Meaden, is revolutionizing everyday spending for individuals living with dementia.

Read moreSurvey Reveals Strong Interest in European Markets Among US and UK Fund Managers

Discover the latest findings from a survey by Carne Group showing a near-consensus among fund managers to raise capital abroad in 2024.

Discover the latest findings from a survey by Carne Group showing a near-consensus among fund managers to raise capital abroad in 2024.

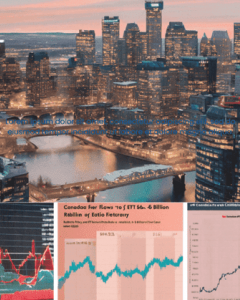

Read moreCanadian ETFs See Record Inflows of $6 Billion in February

National Bank's report reveals highest level of inflows in 11 months, surpassing $400 billion in total assets. Last peak seen in March 2023 amid major economic shifts.

National Bank\'s report reveals highest level of inflows in 11 months, surpassing $400 billion in total assets. Last peak seen in March 2023 amid major economic shifts.

Read more