Sibstar Secures £125K Investment from Dragons’ Den to Enhance Financial Inclusion for Dementia Patients

Learn how Sibstar's innovative debit card and mobile app, backed by Sara Davies and Deborah Meaden, is revolutionizing everyday spending for individuals living with dementia.

Sibstar, a groundbreaking debit card and mobile app designed to assist individuals living with dementia in managing their daily expenses, has recently secured a significant investment of £125K from BBC Dragons’ Den investors, Sara Davies and Deborah Meaden. The funding will be used to further promote financial inclusion and equality for those affected by dementia. The concept for Sibstar was developed by Jayne, a resident of Southampton, who was inspired while caring for her parents with dementia. Jayne, along with her life and business partner, Martin Orton, appeared on Dragons’ Den on 29th February to present their innovative solution to the challenges faced by families dealing with dementia. Both Sara and Deborah were impressed by the success that Jayne had already achieved with Sibstar since its launch in March 2023, despite her lack of prior experience in financial services. The support from external investors has been crucial in bringing Jayne’s vision to life, and the opportunity to pitch on Dragons’ Den was a significant step in securing the necessary resources and expertise to grow the business.

Sibstar operates through a pre-loaded debit card that is managed via the Sibstar mobile app, available on both iPhone and Android devices. The app offers a range of money management features, including spend and ATM limits, online and phone spending controls, instant freeze, auto top-up, and real-time notifications. These functions can be adjusted remotely to suit the changing needs of individual customers. With nearly 1 million people living with dementia in the UK today, and projections indicating a rise to 1.6 million by 2040, the vulnerability of individuals with dementia to financial exploitation and mismanagement is a growing concern. Traditional banking services often fall short in providing the necessary security and functionality for this demographic, leading to restrictions on financial independence and autonomy. Sibstar aims to address this gap in the market by offering a tailored solution that empowers individuals with dementia to manage their finances safely and independently.

The investment from Sara and Deborah, who each offered £62.5K for a 5% stake in the business, will enable Sibstar to expand its reach and impact, providing much-needed support to families affected by dementia. By offering a unique and innovative solution to a pressing societal issue, Sibstar is paving the way for greater financial inclusion and empowerment for individuals living with dementia.

The investment from Sara Davies and Deborah Meaden marks a significant milestone for Sibstar, as it continues to make strides in promoting financial inclusion and equality for individuals living with dementia. The innovative approach taken by Jayne and her team has garnered recognition and support from prominent investors, highlighting the importance of addressing the financial challenges faced by those affected by dementia.

Sibstar Secures £125K Investment from Dragons’ Den to Enhance Financial Inclusion for Dementia Patients

Apartment Stocks Outperforming Other REITs Amid Tough Housing Market

Discover why stocks in companies that own apartment buildings are thriving in the current U.S. housing market, despite overall declines in the real estate sector.

Discover why stocks in companies that own apartment buildings are thriving in the current U.S. housing market, despite overall declines in the real estate sector.

Read moreEmerging Market Equities Outperform US and Europe, Offering Highest Returns

Discover why investing in emerging market equities can yield higher returns than traditional markets like US and Europe. Stay ahead of the game.

Discover why investing in emerging market equities can yield higher returns than traditional markets like US and Europe. Stay ahead of the game.

Read moreUK Government Raises Investment Thresholds for High Net Worth Investors

Learn about the UK government's decision to reinstate private market investment thresholds, making it easier for high net worth individuals to invest.

Learn about the UK government\'s decision to reinstate private market investment thresholds, making it easier for high net worth individuals to invest.

Read moreInside Greece’s Last Golden Visa Program: What’s Changing

Explore Greece's golden visa program, one of Europe's last, and learn about upcoming changes to the controversial residency scheme.

Explore Greece\'s golden visa program, one of Europe\'s last, and learn about upcoming changes to the controversial residency scheme.

Read moreEurope’s Private Credit Funds Relying More on Banks for Funding

Discover the risks associated with European private credit funds turning to banks for funding, as research shows a record 80% utilizing 'subscription lines' in 2023.

Discover the risks associated with European private credit funds turning to banks for funding, as research shows a record 80% utilizing \'subscription lines\' in 2023.

Read moreNorthWall Capital Enhances Credit Business with Sentry Loan Portfolio Management

Learn how NorthWall Capital is optimizing its private debt portfolio with Broadridge's Sentry solution for efficient operations.

Learn how NorthWall Capital is optimizing its private debt portfolio with Broadridge\'s Sentry solution for efficient operations.

Read moreBNP Paribas and Citi Lead Strategic Investment in United Fintech Group Limited

BNP Paribas and Citi invest in United Fintech, signaling a shift towards collaborative fintech innovation. Join the transformative journey.

BNP Paribas and Citi invest in United Fintech, signaling a shift towards collaborative fintech innovation. Join the transformative journey.

Read moreSurvey Reveals Strong Interest in European Markets Among US and UK Fund Managers

Discover the latest findings from a survey by Carne Group showing a near-consensus among fund managers to raise capital abroad in 2024.

Discover the latest findings from a survey by Carne Group showing a near-consensus among fund managers to raise capital abroad in 2024.

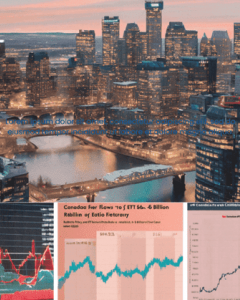

Read moreCanadian ETFs See Record Inflows of $6 Billion in February

National Bank's report reveals highest level of inflows in 11 months, surpassing $400 billion in total assets. Last peak seen in March 2023 amid major economic shifts.

National Bank\'s report reveals highest level of inflows in 11 months, surpassing $400 billion in total assets. Last peak seen in March 2023 amid major economic shifts.

Read more