Europe’s Private Credit Funds Relying More on Banks for Funding

Discover the risks associated with European private credit funds turning to banks for funding, as research shows a record 80% utilizing 'subscription lines' in 2023.

Europe's private credit funds are increasingly turning to banks for funding in order to enhance their performance, raising concerns about the potential risks associated with this growing interconnectedness. According to research from MSCI Private Capital Solutions shared with Reuters, a record 80% of new European private credit funds utilized 'subscription lines' from banks in 2023. These lines allow funds to lend money before collecting cash from their investors. Another study by MSCI revealed that subscription lines are used by credit funds to boost returns, especially in the early stages of operation.

Regulators, including the Bank of England (BoE), are closely monitoring the risks posed by banks' exposure to credit funds, which are less regulated and typically provide financing to companies that struggle to secure loans from traditional banks or bond markets. The surge in shadow banking activities has also raised concerns among some financial experts about the potential formation of new asset bubbles that could threaten financial stability.

In addition to borrowing from banks, some private credit funds are increasing leverage on their loans to maximize returns, but this strategy also amplifies potential losses. This trend comes at a time when corporate distress in Europe has reached its highest level since the onset of the COVID-19 pandemic.

Despite being smaller in size compared to traditional bank lending, European private credit funds now manage an estimated $460 billion, as reported by UBS. The economic slowdown has added to worries that private lending may be delaying necessary business restructuring decisions. However, the lack of detailed public information on credit fund loans and bank leverage makes it challenging for regulators and bank investors to assess the health of credit fund lending activities.

While defaults in the private credit market have been minimal compared to the broader market of lending to riskier borrowers, ratings agency S&P Global projects that defaults by European speculative borrowers could reach 3.75% by June. Deloitte's analysis reveals that nearly 70% of European private debt deals involve only one lender, giving that lender full control over terms and interest rates.

The prevalence of payment-in-kind facilities (PIKs) in European private credit deals has been on the rise, with a significant increase in debt refinancings that extend loan repayments. This trend, along with the potential deployment of leverage, could pose challenges during periods of market stress.

Private credit funds' reliance on bank funding and increased leverage raise concerns about the potential risks to financial stability. Further regulation may be necessary to ensure transparency and mitigate these risks.

Europe’s Private Credit Funds Relying More on Banks for Funding

Apartment Stocks Outperforming Other REITs Amid Tough Housing Market

Discover why stocks in companies that own apartment buildings are thriving in the current U.S. housing market, despite overall declines in the real estate sector.

Discover why stocks in companies that own apartment buildings are thriving in the current U.S. housing market, despite overall declines in the real estate sector.

Read moreEmerging Market Equities Outperform US and Europe, Offering Highest Returns

Discover why investing in emerging market equities can yield higher returns than traditional markets like US and Europe. Stay ahead of the game.

Discover why investing in emerging market equities can yield higher returns than traditional markets like US and Europe. Stay ahead of the game.

Read moreUK Government Raises Investment Thresholds for High Net Worth Investors

Learn about the UK government's decision to reinstate private market investment thresholds, making it easier for high net worth individuals to invest.

Learn about the UK government\'s decision to reinstate private market investment thresholds, making it easier for high net worth individuals to invest.

Read moreInside Greece’s Last Golden Visa Program: What’s Changing

Explore Greece's golden visa program, one of Europe's last, and learn about upcoming changes to the controversial residency scheme.

Explore Greece\'s golden visa program, one of Europe\'s last, and learn about upcoming changes to the controversial residency scheme.

Read moreNorthWall Capital Enhances Credit Business with Sentry Loan Portfolio Management

Learn how NorthWall Capital is optimizing its private debt portfolio with Broadridge's Sentry solution for efficient operations.

Learn how NorthWall Capital is optimizing its private debt portfolio with Broadridge\'s Sentry solution for efficient operations.

Read moreBNP Paribas and Citi Lead Strategic Investment in United Fintech Group Limited

BNP Paribas and Citi invest in United Fintech, signaling a shift towards collaborative fintech innovation. Join the transformative journey.

BNP Paribas and Citi invest in United Fintech, signaling a shift towards collaborative fintech innovation. Join the transformative journey.

Read moreSibstar Secures £125K Investment from Dragons’ Den to Enhance Financial Inclusion for Dementia Patients

Learn how Sibstar's innovative debit card and mobile app, backed by Sara Davies and Deborah Meaden, is revolutionizing everyday spending for individuals living with dementia.

Learn how Sibstar\'s innovative debit card and mobile app, backed by Sara Davies and Deborah Meaden, is revolutionizing everyday spending for individuals living with dementia.

Read moreSurvey Reveals Strong Interest in European Markets Among US and UK Fund Managers

Discover the latest findings from a survey by Carne Group showing a near-consensus among fund managers to raise capital abroad in 2024.

Discover the latest findings from a survey by Carne Group showing a near-consensus among fund managers to raise capital abroad in 2024.

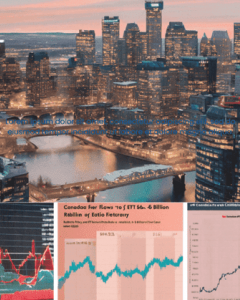

Read moreCanadian ETFs See Record Inflows of $6 Billion in February

National Bank's report reveals highest level of inflows in 11 months, surpassing $400 billion in total assets. Last peak seen in March 2023 amid major economic shifts.

National Bank\'s report reveals highest level of inflows in 11 months, surpassing $400 billion in total assets. Last peak seen in March 2023 amid major economic shifts.

Read more