Emerging Market Equities Outperform US and Europe, Offering Highest Returns

Discover why investing in emerging market equities can yield higher returns than traditional markets like US and Europe. Stay ahead of the game.

The latest "Long View 2024" report from the DWS Research Institute has revealed some interesting insights into the long-term forecasts for major asset classes in 2024. According to the report, return forecasts for equities have seen a significant increase compared to last year's projections. While Europe and emerging markets are now on par with or slightly above the realized returns of the past decade, US equities are still lagging behind.

In terms of regional equity markets, emerging markets are expected to offer the highest forecasted returns, albeit only slightly ahead of certain European markets and the US. The report also highlights positive changes in fixed income return forecasts, with both core fixed income and credit showing higher nominal return outlooks due to current high starting yield levels.

Credit asset classes, including investment grade and high yield corporates, as well as sovereign and corporate emerging market debt, are all expected to outperform returns from the previous decade. Notably, emerging market US dollar sovereign and corporate debt stand out as having the highest return forecasts among credit asset classes.

Alternative asset class return forecasts are in line with or slightly below traditional asset class forecasts, with infrastructure equity offering the highest return outlook. However, private real estate equity forecasts have declined, attributed to a methodology change and less attractive valuations relative to TIPS yields.

Commodity future return forecasts have shown improvement compared to the poor returns of the previous decade, potentially offering diversification benefits and inflation protection. Overall, the report paints a positive picture for the investment landscape in 2024, with various asset classes showing promising return prospects.

The "Long View 2024" report by the DWS Research Institute provides valuable insights for investors looking to navigate the financial markets in the coming years. With increased return forecasts across equities and fixed income, as well as potential opportunities in alternative asset classes, investors may find new avenues for growth and diversification in their portfolios.

Emerging Market Equities Outperform US and Europe, Offering Highest Returns

Apartment Stocks Outperforming Other REITs Amid Tough Housing Market

Discover why stocks in companies that own apartment buildings are thriving in the current U.S. housing market, despite overall declines in the real estate sector.

Discover why stocks in companies that own apartment buildings are thriving in the current U.S. housing market, despite overall declines in the real estate sector.

Read moreUK Government Raises Investment Thresholds for High Net Worth Investors

Learn about the UK government's decision to reinstate private market investment thresholds, making it easier for high net worth individuals to invest.

Learn about the UK government\'s decision to reinstate private market investment thresholds, making it easier for high net worth individuals to invest.

Read moreInside Greece’s Last Golden Visa Program: What’s Changing

Explore Greece's golden visa program, one of Europe's last, and learn about upcoming changes to the controversial residency scheme.

Explore Greece\'s golden visa program, one of Europe\'s last, and learn about upcoming changes to the controversial residency scheme.

Read moreEurope’s Private Credit Funds Relying More on Banks for Funding

Discover the risks associated with European private credit funds turning to banks for funding, as research shows a record 80% utilizing 'subscription lines' in 2023.

Discover the risks associated with European private credit funds turning to banks for funding, as research shows a record 80% utilizing \'subscription lines\' in 2023.

Read moreNorthWall Capital Enhances Credit Business with Sentry Loan Portfolio Management

Learn how NorthWall Capital is optimizing its private debt portfolio with Broadridge's Sentry solution for efficient operations.

Learn how NorthWall Capital is optimizing its private debt portfolio with Broadridge\'s Sentry solution for efficient operations.

Read moreBNP Paribas and Citi Lead Strategic Investment in United Fintech Group Limited

BNP Paribas and Citi invest in United Fintech, signaling a shift towards collaborative fintech innovation. Join the transformative journey.

BNP Paribas and Citi invest in United Fintech, signaling a shift towards collaborative fintech innovation. Join the transformative journey.

Read moreSibstar Secures £125K Investment from Dragons’ Den to Enhance Financial Inclusion for Dementia Patients

Learn how Sibstar's innovative debit card and mobile app, backed by Sara Davies and Deborah Meaden, is revolutionizing everyday spending for individuals living with dementia.

Learn how Sibstar\'s innovative debit card and mobile app, backed by Sara Davies and Deborah Meaden, is revolutionizing everyday spending for individuals living with dementia.

Read moreSurvey Reveals Strong Interest in European Markets Among US and UK Fund Managers

Discover the latest findings from a survey by Carne Group showing a near-consensus among fund managers to raise capital abroad in 2024.

Discover the latest findings from a survey by Carne Group showing a near-consensus among fund managers to raise capital abroad in 2024.

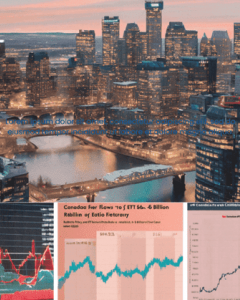

Read moreCanadian ETFs See Record Inflows of $6 Billion in February

National Bank's report reveals highest level of inflows in 11 months, surpassing $400 billion in total assets. Last peak seen in March 2023 amid major economic shifts.

National Bank\'s report reveals highest level of inflows in 11 months, surpassing $400 billion in total assets. Last peak seen in March 2023 amid major economic shifts.

Read more