Inside Greece’s Last Golden Visa Program: What’s Changing

Explore Greece's golden visa program, one of Europe's last, and learn about upcoming changes to the controversial residency scheme.

Greece is one of the few remaining countries in Europe that still offers golden visas, a controversial 'residency by investment' scheme that allows wealthy foreigners to obtain long-term residency by purchasing property or making investments in the country. While many EU nations have abolished such schemes due to concerns over security and inflation, Greece has continued to offer them since 2013, when the country was in the midst of a financial crisis.

Initially, the golden visa programme in Greece required a real estate investment of €250,000 or more to obtain a five-year residence permit, which could eventually lead to citizenship after seven years. However, last year, the government raised the investment threshold to €500,000 in certain areas, and there are now talks of further increasing it to €800,000 in select locations.

The decision to raise the investment threshold is aimed at addressing concerns over inflated house prices and rental pressures in certain parts of the country. Prime Minister Kyriakos Mitsotakis has stated that the higher threshold will help attract more investment into Greece while reducing the number of golden visas issued.

While the golden visa programme has brought significant revenue to the Greek state, critics argue that it has strained local resources and contributed to rising rent and real estate prices. Some have called for real estate to be removed as an investment option for golden visas, while others suggest reducing the threshold for investments in specific regions that need development and job creation.

Despite the government's efforts to control foreign ownership of property through the golden visa programme, the announcement of the investment increase may actually lead to a rush for property purchases. Mitsotakis has expressed a desire for the programme to be used as a development tool in regions that require investment and job creation, suggesting potential reductions in the investment threshold for certain types of investments.

Greece's decision to increase the golden visa investment threshold reflects the government's efforts to balance the economic benefits of the programme with concerns over housing prices and rental pressures. The future of the programme may involve further adjustments to promote sustainable development and address local resource strains.

Inside Greece’s Last Golden Visa Program: What’s Changing

Apartment Stocks Outperforming Other REITs Amid Tough Housing Market

Discover why stocks in companies that own apartment buildings are thriving in the current U.S. housing market, despite overall declines in the real estate sector.

Discover why stocks in companies that own apartment buildings are thriving in the current U.S. housing market, despite overall declines in the real estate sector.

Read moreEmerging Market Equities Outperform US and Europe, Offering Highest Returns

Discover why investing in emerging market equities can yield higher returns than traditional markets like US and Europe. Stay ahead of the game.

Discover why investing in emerging market equities can yield higher returns than traditional markets like US and Europe. Stay ahead of the game.

Read moreUK Government Raises Investment Thresholds for High Net Worth Investors

Learn about the UK government's decision to reinstate private market investment thresholds, making it easier for high net worth individuals to invest.

Learn about the UK government\'s decision to reinstate private market investment thresholds, making it easier for high net worth individuals to invest.

Read moreEurope’s Private Credit Funds Relying More on Banks for Funding

Discover the risks associated with European private credit funds turning to banks for funding, as research shows a record 80% utilizing 'subscription lines' in 2023.

Discover the risks associated with European private credit funds turning to banks for funding, as research shows a record 80% utilizing \'subscription lines\' in 2023.

Read moreNorthWall Capital Enhances Credit Business with Sentry Loan Portfolio Management

Learn how NorthWall Capital is optimizing its private debt portfolio with Broadridge's Sentry solution for efficient operations.

Learn how NorthWall Capital is optimizing its private debt portfolio with Broadridge\'s Sentry solution for efficient operations.

Read moreBNP Paribas and Citi Lead Strategic Investment in United Fintech Group Limited

BNP Paribas and Citi invest in United Fintech, signaling a shift towards collaborative fintech innovation. Join the transformative journey.

BNP Paribas and Citi invest in United Fintech, signaling a shift towards collaborative fintech innovation. Join the transformative journey.

Read moreSibstar Secures £125K Investment from Dragons’ Den to Enhance Financial Inclusion for Dementia Patients

Learn how Sibstar's innovative debit card and mobile app, backed by Sara Davies and Deborah Meaden, is revolutionizing everyday spending for individuals living with dementia.

Learn how Sibstar\'s innovative debit card and mobile app, backed by Sara Davies and Deborah Meaden, is revolutionizing everyday spending for individuals living with dementia.

Read moreSurvey Reveals Strong Interest in European Markets Among US and UK Fund Managers

Discover the latest findings from a survey by Carne Group showing a near-consensus among fund managers to raise capital abroad in 2024.

Discover the latest findings from a survey by Carne Group showing a near-consensus among fund managers to raise capital abroad in 2024.

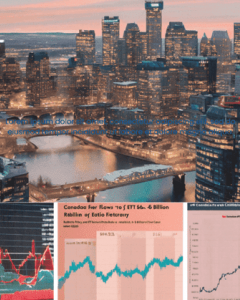

Read moreCanadian ETFs See Record Inflows of $6 Billion in February

National Bank's report reveals highest level of inflows in 11 months, surpassing $400 billion in total assets. Last peak seen in March 2023 amid major economic shifts.

National Bank\'s report reveals highest level of inflows in 11 months, surpassing $400 billion in total assets. Last peak seen in March 2023 amid major economic shifts.

Read more